When discussing strong and weak markets, economic boom times, and recession, it is very easy to get caught up in the emotion. Do you cash in your investments, ride the difficult times or consider each investment in isolation? This prompts the question, what is the length of the average recession, and how long does the average period of economic growth last?

Before we look at typical mistakes made during times of economic challenges, it is vital to appreciate the length of the average economic cycle.

Boom and bust

Capital Group published an in-depth report on times of economic growth and recession in the US. You can use this information to make short, medium, and long-term investment decisions. Using data going back to 1950, the report found that:-

- The average period of economic growth lasts 69 months

- The average increase in GDP equates to 24.6%

- A net 12 million jobs are added during periods of economic growth

To put this into context, the average recession:-

- Lasts ten months

- Experiences economic growth of -2.5%

- This equates to job losses of 3.9 million

While some periods of economic growth and recession will be far more significant, it is essential to look at the average to put everything into perspective.

Weak markets and recessionary times

Investors are, on the whole, optimistic regarding their vision of the future and the performance of their investments. However, even though this is borne out in the above figures, it is essential to be aware of the potential mistakes many investors make during weak stock markets and recessionary periods.

Focusing on fundamentals

Firstly, there is nothing wrong with taking a profit or a loss; there never has been and never will be. There is a time and a place for all investment actions. However, it would be best to focus on the company’s fundamentals when looking at a long-term investment. Take a step back from the emotive headlines which often precede a recession, and put things into perspective.

The report by Capital Group, while focused on the US, found that equities are between six and seven months ahead of the economic cycle. So, suppose you decide to ditch everything when the recession is confirmed. In that case, the rating for individual companies (and the market as a whole) will likely reflect part of the damage from a recession. If the average recession lasts just ten months, and markets are up to 7 months in advance of the economic cycle, in theory, you may be selling just before the final three months before recovery.

We also know that markets bounce back quicker after a recession than they fall prior to a recession. This again reflects the often optimistic nature of investors and the actions of central banks to encourage essential economic growth.

Selling to buy back lower down

While the introduction of online trading has, for many people, cut trading margins to the bone, it is vital to appreciate the cost of selling a share with the intention of buying it back. Many investors will look to sell their shares on confirmation of a recession, hoping to repurchase them lower down. This introduces a number of challenges to the mix:-

- Trading costs could add up to a few percentage points; is it worth the risk of being out?

- Trying to buy at the bottom of the cycle is akin to catching a falling knife, dangerous

- Markets bounce back much quicker after a recession; might you miss the recovery?

This prompts the question: Is it worth the risk for those looking to make a turn by selling at the top and buying back at the bottom? Alternatively, if the fundamentals of the companies you invest in remain solid, is it less stressful to ride the short-term recession?

Never deal on emotion

Whether looking at short, medium or long-term investments, it is important to be pragmatic and keep an open mind, avoiding the temptation to deal based on emotion. The moment you let your heart rule your head is a turning point for many investors. They are ignoring fundamentals and dealing with raw emotion.

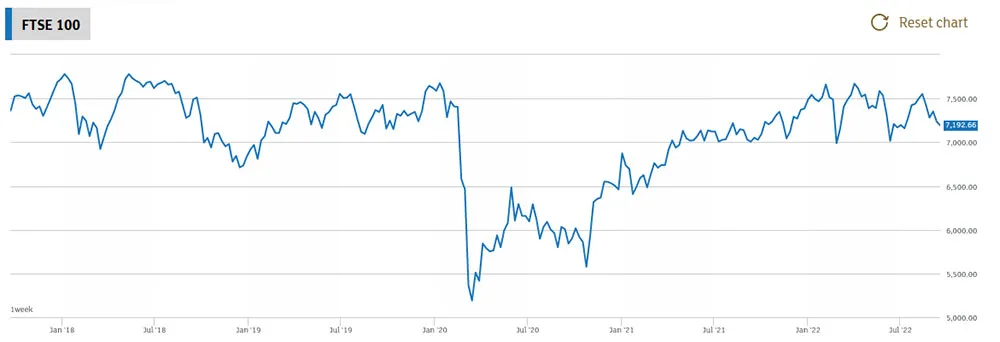

It is fair to describe the Covid pandemic as a “black swan event”, something as brutal as it was unexpected. The initial emergence of Covid in December 2019 was ignored for some time, and then reality hit home in early 2020. The FTSE 100 fell from 7500 to 5250, circa 30%. However, within 12 months, the market was just 10% below the pre-Covid level, reaching its peak in early January 2022.

During the doom and gloom of the initial days after the outbreak of Covid, people slowly began to realise this was a serious problem. Many investors held on for the recovery, only to panic and sell at the bottom. As a consequence of the growing doom and gloom, it was obvious that the market would be oversold at some point, which occurred in the first quarter of 2020. Investors taking a long-term view focused on fundamentals rather than short-term challenges could take advantage.

The fall in the FTSE is a weighted average of the various components; therefore, by definition, many share prices would have performed even worse. For example, we know that the worst performing sectors during recession/economic challenges are industrials, financials, information technology, and consumer discretionary. During the 30% fall in the FTSE 100, there were massive swings in the share prices of technology companies. Value investors quickly bought up oversold positions, taking advantage of emotive sales on a short-term outlook.

Experience is invaluable

In challenging economic times, the life of a trader/long-term investor can be a lonely one. This is where the value of talking to an advisor, bouncing ideas off each other, and putting things into perspective can be priceless. It is essential to recognise that experience in the world of financial advice is not measured by years alone but by actual experiences. Recessions come and go, black swan events are rare but potentially catastrophic, and it is vital to remain focused on the long-term.

Unfortunately, some investors don’t have the benefit of an advisor to talk to, someone who has been there, done it, and lived to tell the tale. We live in a world where the Internet affords us access to a raft of information, the likes of which we have never seen before. However, the Internet can’t teach you experience, how you feel when managing your investment through a recession and how to retain a long-term outlook based on fundamentals.

Summary

As predictable as night following day, many investors lose their composure during challenging markets and switch from fundamental-based investment to pure emotion. The ever-growing number of headlines suggesting doom and gloom is just around the corner, job losses are on the way, and the end of the world is nigh can challenge the most positive of investors. Of course, there is nothing wrong with taking a profit or a loss, there are times and places to do this, but this should be done within a cold clinical setting, devoid of emotion.

It is important to remember the belief that the US stock market is between six and seven months ahead of the economy (some suggest up to 9 months in the UK). So when a recession is confirmed, the markets could be up to 7 months through the recessionary period, just before an often sharp upturn. These are the scenarios in which an advisor can be priceless, using their practical and academic experience to retain a long-term investment strategy.

We hope you found this newsletter useful, but if you have any further questions or would like more information please get in touch.

Source:

https://www.capitalgroup.com/advisor/insights/articles/guide-to-recessions.html